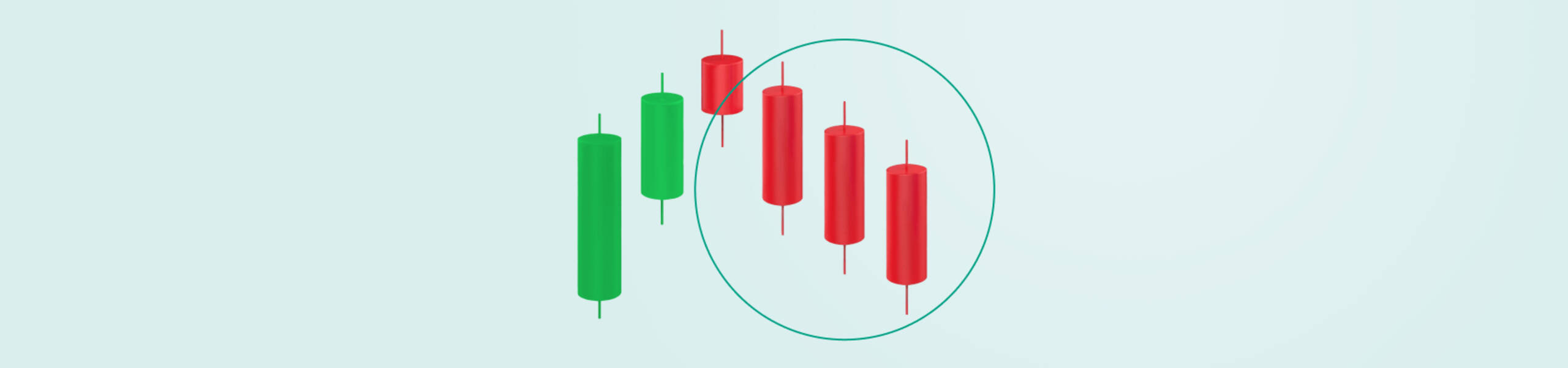

In trading, we can rely on a bunch of different entry signals.

2023-04-03 • Updated

There is no doubt that diversification is the key to success in investing. World's markets do not move the same way, and diversification between asset classes with low correlation to one another in the appropriate proportions can reduce risks of capital loss. Combining foreign and domestic assets tends to have a magical effect on long-term returns and portfolio volatility. However, these benefits also come with some underlying risks.

Investors who plunk down money overseas make bets not only on stock or bond but also on the currency market. If the foreign stock market they invested in grows by 5% and at the same time the national currency of this country falls by 5% to investor’s national currency, the profit gets wiped out.

For example, from July 1995 to March 2002, the total currency impact due to a rising dollar was a negative 57.3 percent compared to the European, Australian, and Far East currencies. From April 2002 to December 2011, the impact due to a falling dollar was a positive 54.4 percent compared to the same locations.

Traders should not forget about currency risk when investing in a foreign country's market.

Hedge your portfolio with a currency-hedged mutual fund or invest in an exchange-traded fund. These funds remove the risk for you, so you only must worry about stock market returns. Hedging against movements in the Japanese yen would have been a wise decision over the last year and a half. Since January 1, 2013, the Nikkei Index has climbed 45 percent, but the yen is down 13 percent. Many ETFs that hedge currencies have been introduced within the past year and now this type of fund is available worldwide.

Countries with a high debt usually head towards an inflation increase. Inflation is the main factor, which negatively affects national currency. On the other hand, countries with a low GDP have strong currencies worth investing in. Investors should look for countries with a healthy economy and stick with it.

Also, an investor should pay attention to the current account deficit, which is calculated as a difference between a country’s imports and export. If this meaning grows consistently, the currency of this country might become uncompetitive.

Bonds are especially vulnerable to currency fluctuations since they have lower gains to offset currency losses. Investing in a foreign bond index can give investors from plus 10 to minus 10 percent of profit. This amount is double what a bond may return. This fact makes a foreign bond market a minefield, where an investor can lose a big amount of his capital.

Currency fluctuations have a much greater impact on foreign bonds than changes in the bonds’ prices. Historically, most foreign-country bonds were issued in dollar valuations. Today, many are issued in local currencies. Still, investors can find bonds issued in dollars, and that can be a more stable investment.

Another way to hedge currency risks is to short currency which stock market you work with. For example, an investor can purchase iShares MSCI Japan ETF and then short Japanese Yen ETF. If the Japanese yen falls against the US dollar investor will benefit from shorting currency ETF.

More risky investors can short currencies they think will fall in value without a hedge. Every currency trades in pairs, though, so investors also have to buy another currency for this transaction to work.

Essentially, investors exchange one currency for another. If he/she believes the euro is going to get weaker against the US dollar, the best option will be to sell that currency and buy, for example, U.S. dollars. In this case, you need to open the EUR/USD currency pair and short it.

After the euro reaches the target, an investor buys it back at a lower rate, and the difference between the selling price and the buying price is the profit.

Investments in any kind of overseas assets have to be hedged from currency risk. There are several types from the riskiest one to the savest.

FBS allows traders to buy and sell currencies from over 15 countries, which provides them with a huge number of hedge options.

In trading, we can rely on a bunch of different entry signals.

What defines a good, profitable, and wealthy trader from the bad one? Some say it’s all about a trading strategy; others point to a mindset and trading psychology.

Wars start and end, centuries change and the metals stay the best safe-haven assets to invest in. Why are they so recognizable among investors?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!