-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to open an FBS account?

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Take-Profit Order

Take-Profit Order

What is a Take-Profit (T/P) order?

A Take Profit order is an order used by traders to ensure that the order is closed when it reaches a certain level, chosen by a trader. In combination with a Stop Loss order, Take Profit orders are often used by traders in their trading plans to limit losses and maximize profits on specific asset. A Take Profit order is an automatic exit strategy based on a profit and loss calculation rather than an emotional decision to sell or hold.

How does a Take Profit order work?

Like a Stop Loss order, a Take Profit is an exit order. However, unlike SL, which limits the trader's losses on a trade, TP is set a specific price at which a profitable trade is automatically closed. In other words, TP is a profit target. You need a TP link at the level that is expected from the price. If you buy, Take Profit should be above the prices. If you sell, it will be lower. You may have a brilliant trade idea, but if you take the Take Profit level poorly, you won’t make as much profit as you could have made.

Placing a Take Profit order requires a technical analysis of likely movement of the market. Additionally, you may find Take Profit orders useful if you are a trader with a short-term strategy. Using one of them allows the day traders to exit the market as soon as they reach their profit target for the day.

Often, the shorter a trader's strategy, the better a Take Profit order is for that trader. Short-term traders without a Take Profit target can quickly notice that the profit they make is slipping away if they don't have a good understanding of the right moment to get out.

Pros and cons of Take Profit orders

Each trader has a different level of risk, different goals and timeframes that they work with while trading. If you are aware of the pros and cons of a Take Profit order, it will be easier for you to understand whether this trading strategy is right for you.

The advantages of Take Profit order include profit making, risk minimizing and preventing second-guessing. If your order is completed, you will surely make money on the trade. A Take Profit order allows you to benefit from the rapid rise in the market and not to miss out the potential chance to get a profit. In addition, traders using Take Profit orders don’t have to decide what the best moment to close the trade is. The transaction occurs automatically without the risk of re-evaluation of your decision.

However, Take Profit orders are a short-term strategy that ensures you get some profit level quickly. They aren’t suitable for long-term traders who’d like to endure more ups and downs in the market in order to make more profits. Then, Take Profit orders mostly can’t be profitable with long-term trends. Trend traders who use Take Profit are often frustrated when they find a good trend and get out of it too early. Finally, the presence of a Take Profit order doesn’t guarantee that an exit will occur. If the market never gets to the Take Profit level you set, you may still have to close a trade with a loss.

The best solution for trend traders may be a trailing Stop Loss. This order will automatically follow the price when the price goes in favor of a trading position. Thus, a trailing Stop Loss is a way to get the most out of a trend and take profit at the right time.

How to set the Take Profit order?

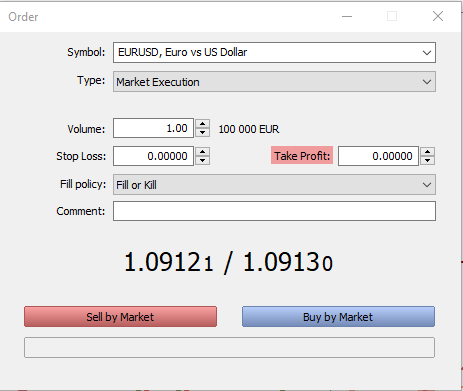

To set Take Profit in MetaTrader 4 and 5, you need to click “New Order” and then in the popup set the necessary Take Profit.

When you set your Take Profit, you should consider the risk/reward ratio. This ratio shows how much profit the trader expects in exchange for the risk of a limited loss. In general, the best ratio is 1:3, so the profit should be three times greater than the loss. For example, if your Stop Loss is 50 points, your Take Profit should be 150 points.

In some cases, other risk-reward ratios are possible. For example, if you trade a breakout of a level, you’d like to use a 1:5 ratio as the chance of a false breakout is high and to protect yourself more.

2022-04-29 • Updated