Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2022-12-15 • Updated

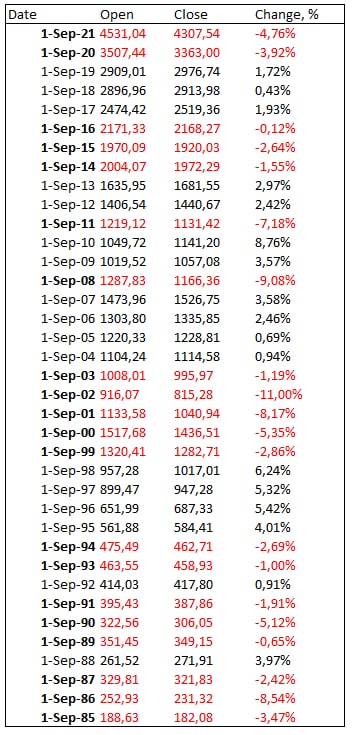

There is a possibility that this scenario may repeat itself. Investors' fears are not unfounded because September is the worst month for the index. According to the historical dynamics, S&P 500 (US500) has been declining in September by 0.65% over the past 38 years.

September S&P500 (US500) index performance since 1985.

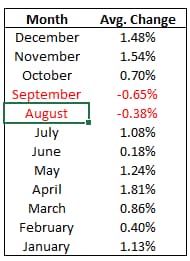

Average change of the S&P 500 (US500) index during the past 36 years.

The Crypto market usually also has a rough time in September. Bitcoin lost 12.7% in September 2021, 17.4% in 2020, 17.5% in 2018, 21.4% in 2017 and 45.4% in 2015. The main cryptocurrency increased by 13.3% and 3.95% in 2016 and 2019, respectively.

However, the extrapolation of statistical data to the current situation makes little sense if it is not tied to the economic context.

Several factors confirm a possibility of a deeper correction:

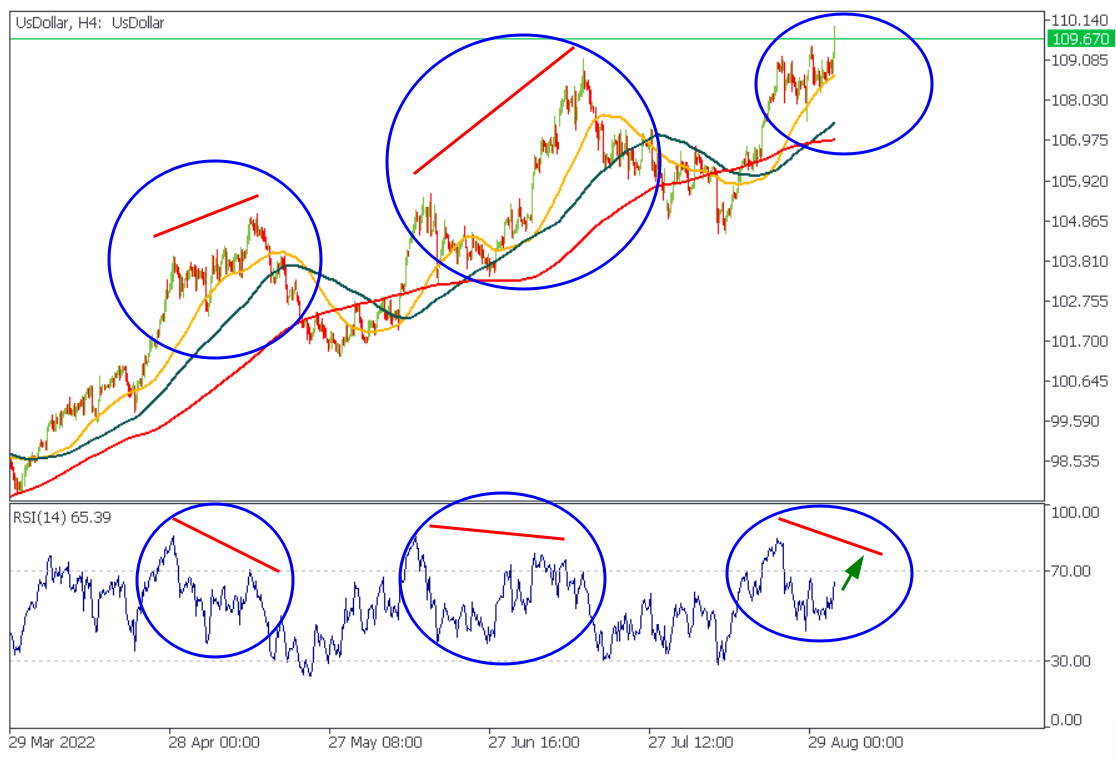

US dollar index, H4

The RSI repeats the same pattern, which has also appeared twice in 5 previous months.

The H4 RSI goes to 84 -> RSI declines, while the price stays at the same level -> Another pump when RSI reaches 70 - 75 -> divergence appears -> deeper correction happens.

The US dollar index is already breaking above a recent high, and currently, the price is aiming at the 111.50 level.

US500, weekly

US500 keeps moving inside an inverted falling wedge. The price has formed a massive range between 3500 and 3650, and it seems like sellers are aiming for it. Moreover, the 200-week moving average, which always acts as the main support for the US500, also stands in this range. If the Fed increases the rate by 75-basis-points, the price will easily decline to this support, where we expect to see the overall market reversal.

Do you want to get updates Live? Subscribe to the @FBSAnalytics Telegram Channel, where I post more daily trade ideas!

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

After creating record highs, Wall Street's main indexes opened on Wednesday and began to edge lower, reflecting cautious sentiment among investors. They're eagerly awaiting crucial inflation data that could impact the U.S. Federal Reserve's interest rate decisions. The upcoming release of the personal consumption expenditures (PCE) price index is expected...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!