Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has suggested that these individuals will be the ones to benefit the most from the decision. Moreover, the market is currently seeing record levels of competition, which is great news for consumers, as banks are vying to win over as many customers as possible. With 880,000 borrowers coming off their fixed-rate mortgages this year, the market will be even more competitive than ever. So, if you're a forex trader keeping an eye on the Australian market, here are a few technical analyses to assist.

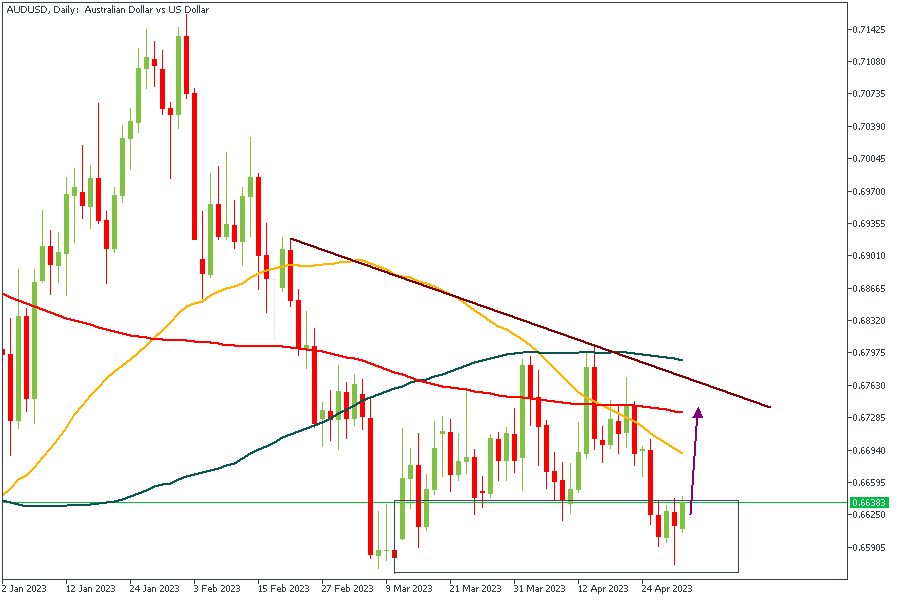

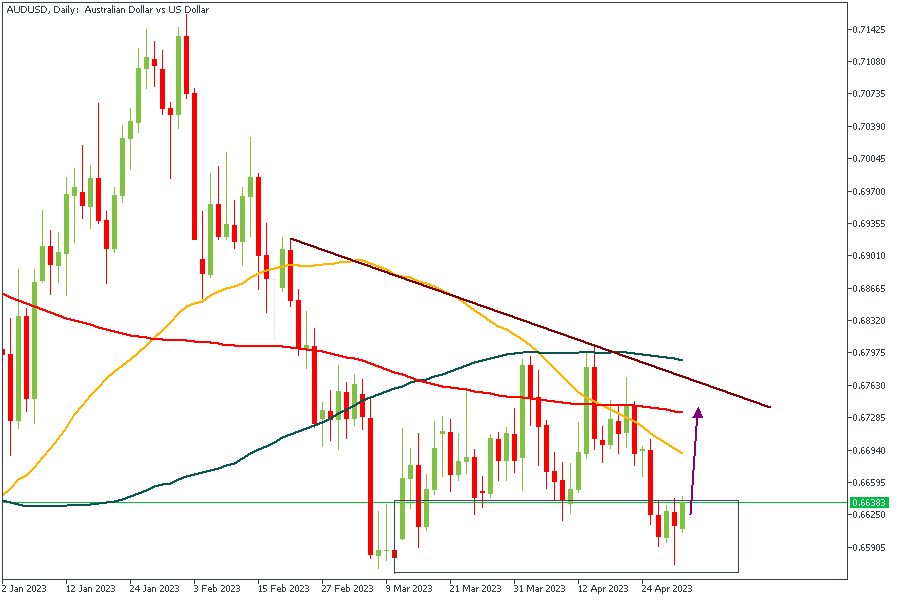

AUDUSD - Daily Timeframe

AUDUSD closed last week with a reversal pin bar candlestick. My major interest, however, is that the reversal candle was formed right inside a drop-base-rally demand zone, thus confirming a bullish intent with the 100-Day moving average as a likely target.

Analysts’ Expectations:

Direction: Bullish

Target: 0.67028

Invalidation: 0.65567

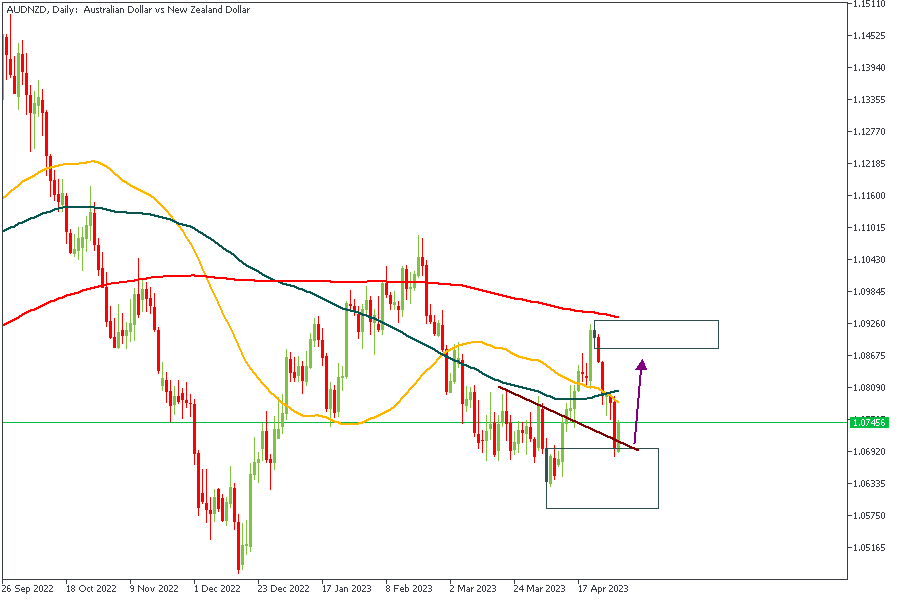

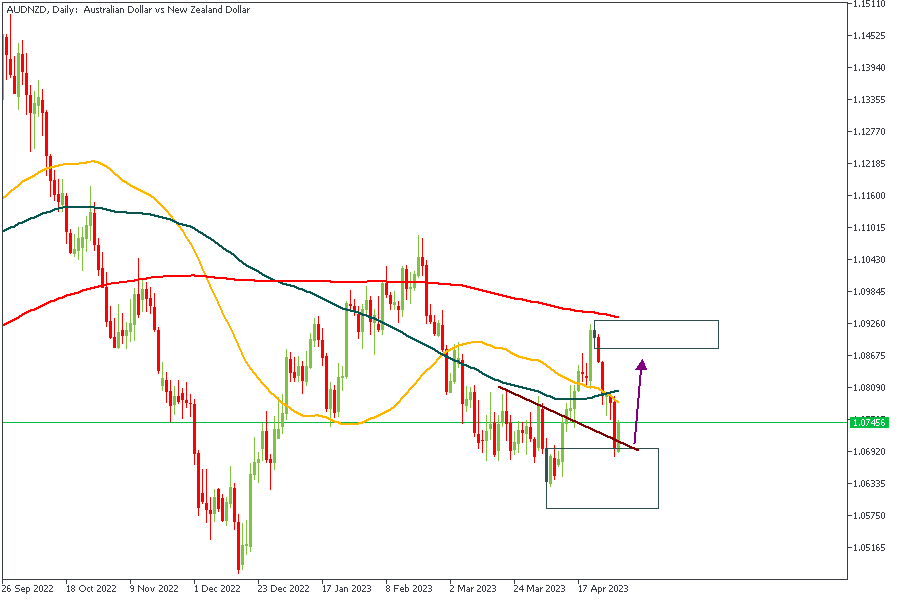

AUDNZD - Daily Timeframe

The AUDNZD chart above is clear on one thing; the intent of the current price action is bullish. This can be judged based on the break of the previous high (at the second retest of the trendline), the reaction from the drop-base-rally demand zone, the retest of the trendline, and the 76% of the Fibonacci retracement tool.

Analysts’ Expectations:

Direction: Bullish

Target: 1.08727

Invalidation: 1.06193

AUDJPY - Daily Timeframe

AUDJPY's price action is currently within the range of a drop-base-drop supply zone. This same zone is also a confluence area for the two resistance trendlines. Considering the bearish alignment of the moving averages, the bearish sentiment is the most logical conclusion based on the observed data we've already discussed.

Analysts’ Expectations:

Direction: Bearish

Target: 89.084

Invalidation: 91.798

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.