Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

2021-07-20 • Updated

S&P500 Daily chart

S&P500 has shown its weakness during the last two weeks and the historical data says the correction is not over yet. Ever since the market had crashed in 2020, we have seen several S&P500 corrections with one thing in common. During every correction, the price has been touching at least the 50-day moving average. This one would not be an exception. With the bearish divergence on a daily chart, the price will drop down to 4250 first. If this price breaks this support level, it will head towards 4200.

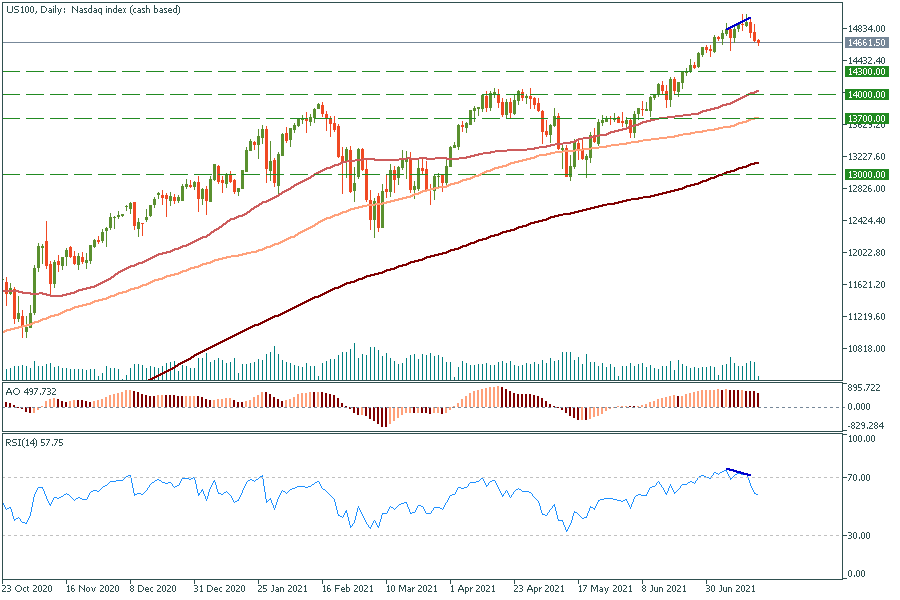

US100 Daily chart

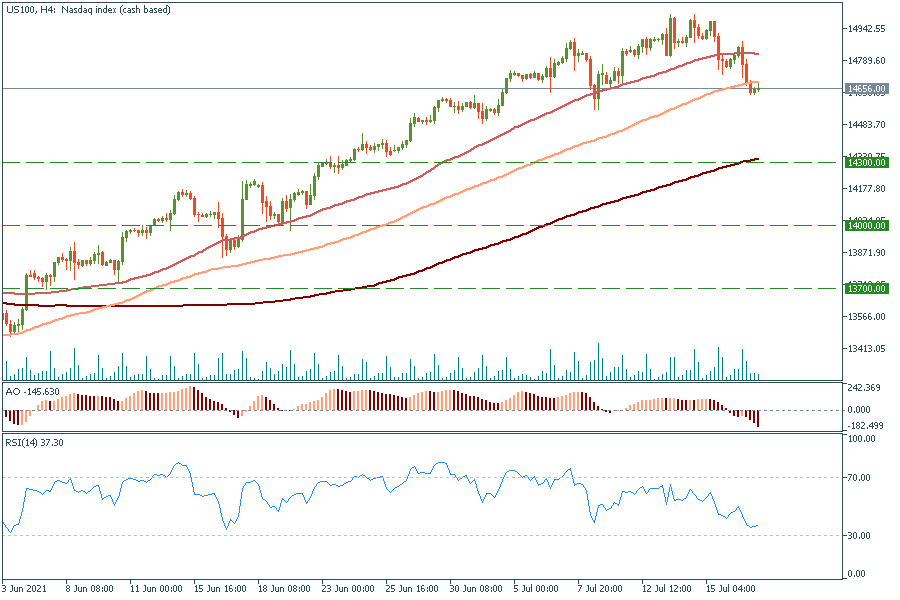

US100 4H Chart

Nasdaq (US100) had been also falling during the last week. During last year during every correction, the price had been reaching 100-day moving average. With the bearish divergence on a daily chart, the price will aim towards the range between 13700 and 14000.

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

During his program on CNBC on February 28, Jim Cramer expressed frustration with the impact of earnings reports on market behavior, noting how they often prompt rash decisions by average investors. He criticized the short-term focus and lack of attention to nuance in news coverage of earnings. Cramer cited examples of Home Depot and Lowe's, highlighting how investors reacted hastily to headline news without considering the broader context provided in earnings calls.

As the year winds down and the festive spirit takes hold, the stock market often presents a curious yet anticipated phenomenon known as the Santa Rally. Within this whirlwind of festive trading, let’s look at how two titans of the tech world, Amazon and Apple, might fare during this unique season.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!