Virus status

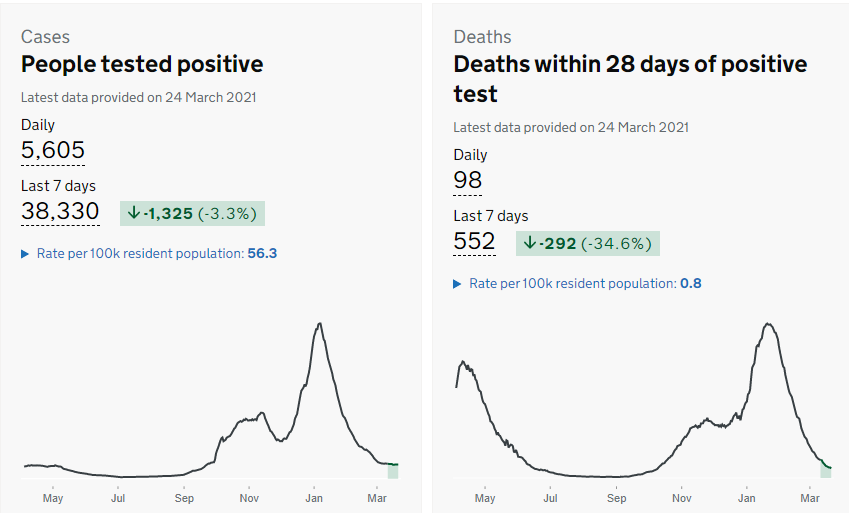

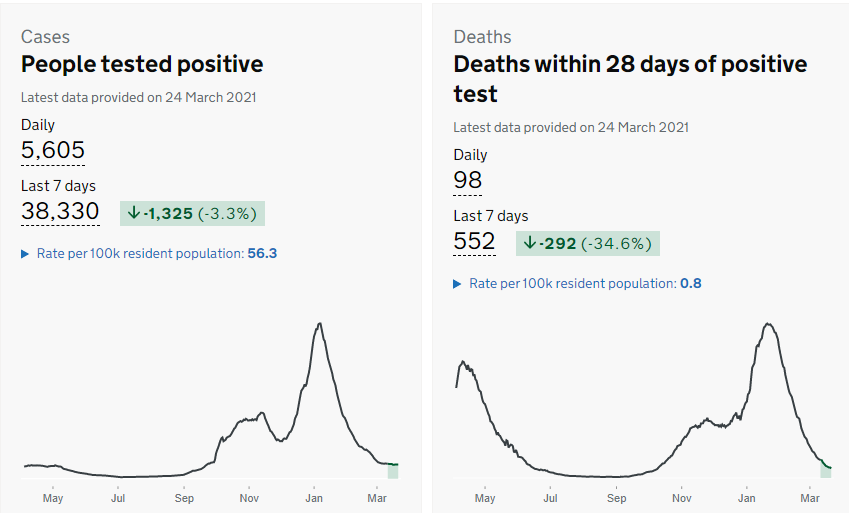

Thanks to the rapid deployment of the vaccines, the virus dynamics in the UK are consistently improving. As the below charts show, the number of infections is dropping as does the mortality rate. At the moment, it’s the primary fundamental factor that lets observers assume the coming of economic recovery in the UK.

Source: https://coronavirus.data.gov.uk/

Labor market

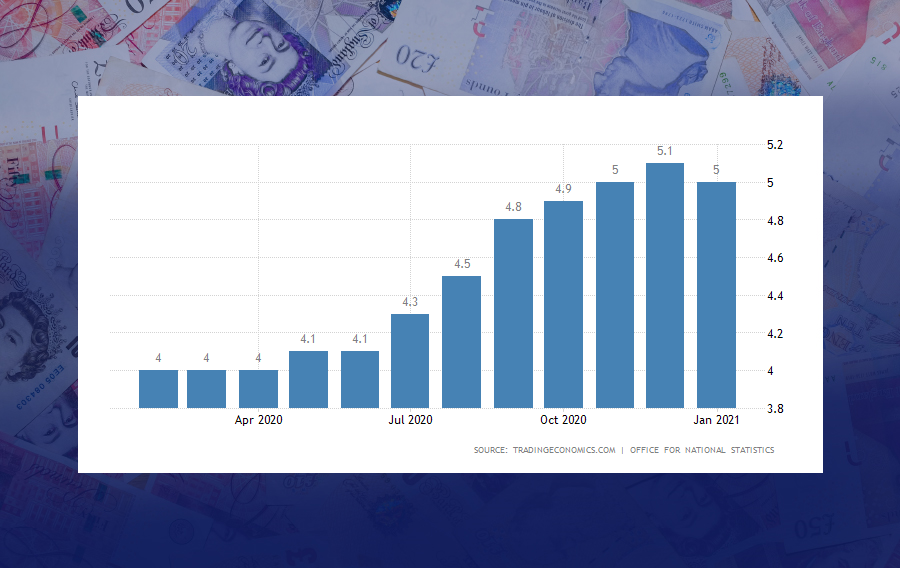

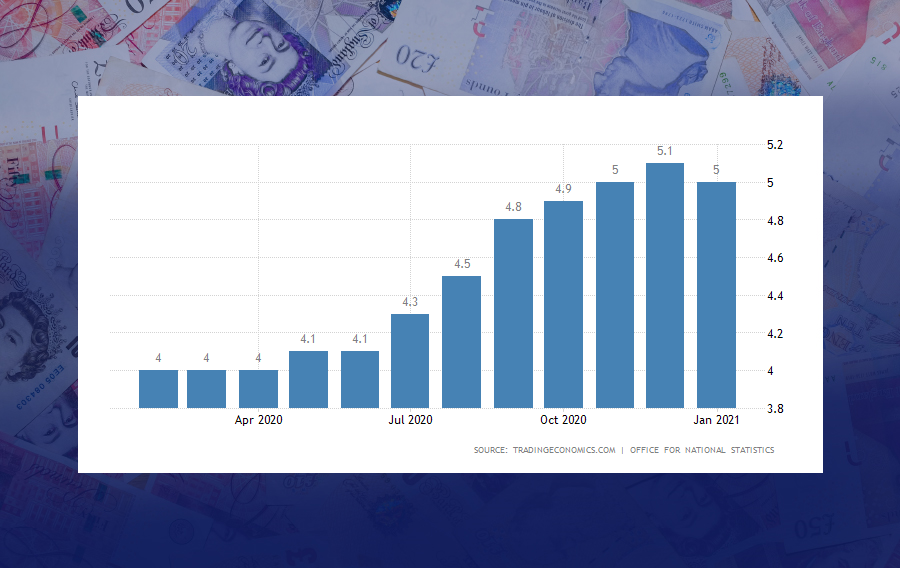

In the meantime, unemployment appears to have passed the peak in December-January – that corresponds to the peak of infections in the same period. The number of employed people grew almost 70,000 in February giving reason to assume that the jobless rate will be less than 5% in that month. In general, companies are reported to take an upward curve as they are hiring more in expectation of the ending lockdown and improved humanitarian and, hence, economic environment.

Inflation

In the meantime, inflation eased to 0.4% in the UK. Analysts say it’s the result of the drop in the prices of clothes and leisure items that saw lower demand recently. However, observers comment that the stockpiles of cash accumulated over lockdowns and lower consumer activity may soon spur the economy as people are expected to spend more. The Bank of England’s target is 2% for the first part of the year. The Chancellor of the Exchequer Rishi Sunak’s policy on continuing furlough payments to the UK citizens may help reach that objective on time.

The pound

In recent months, the GBP gained significantly against the USD and the EUR. That is, despite all the Brexit hurdles and the worst economic crisis in the UK for the last 300 years. Optimism about the British economy suggests further strengthening of the pound beyond its current levels. However, another version is that as the global economy recovers with the USD and the EUR restoring their value, the pound will get back to its pre-virus levels: GBP/USD to the area of 1.30 and EUR/GBP to 0.90. The coming months will confirm – or disprove – if there will be signs of the trends that would correspond to this assumption. In any case, the economy is fundamentally on a clear recovery path in the UK.

LOG IN