Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2021-02-01 • Updated

Amazon reports it Q4'2020 earnings on February 3, 00:30 MT time (after Tuesday’s midnight).

Since August 2020, the highest point for the Amazon stock price has been 3 545 and the lowest – 2 900. For six months, the price has been oscillating between these two extremes with diminishing magnitude to gradually convert into the last episode of sideways channel 3 100 – 3 345. Logically, as long as the fundamental outlook for Amazon is positive, the price is likely to bounce upwards and eventually cross the resistance levels of 3 345, 3 445, and 3 545 to take direction to new all-time highs. Otherwise, it may be going sideways for quite a considerable period. That’s why we need to see the Quarterly Earnings Report on February 3, 00:30 MT time (after Tuesday’s midnight).

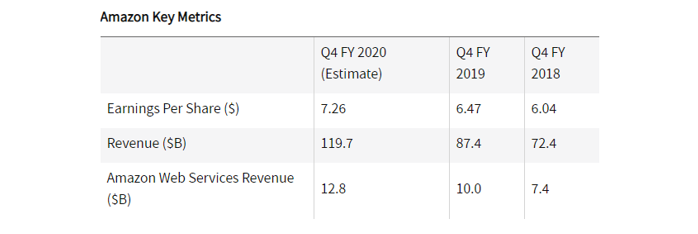

While in the 3000-plus zone, Amazon’s stock price is slightly underperforming against the Wall Street 52-week expected mark of 3 800. In terms of EPS, the expectation is 7.26 for the Q4’2020. Observers are mostly positive about the possible results: the performance of Amazon’s key businesses (cloud computing and e-commerce) is expected to be promising. Also, Amazon Prime Day took place during Q4 and it will likely contribute to the financial result. Therefore, a rise back up to 3 545 seems to be a likely result of the Q4 performance announcements. In the mid-term, it may turn out to be an impulse required to push the stock price above the 6-month resistance.

Source: Investopedia

Don't know how to trade stocks? Here are some simple steps.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!